Over the century we’ve increased in both size and footprint, achieving several milestones along the way. We were one of the first banks in the state to pay daily interest on savings accounts and we pioneered specialized lending for personal needs like appliances and autos in the 30’s. A decade later we redefined personal banking by meeting ship builders on the docks during the war years so they didn’t have to leave work to cash their paychecks. Around that same time, we brought the first drive-thru banking windows to Northern California and later went on to establish a full-service trust department and a commercial lending practice to grow in step with the region.

Capital strength has always been central to Mechanics Bank’s success. Enduring economic downturns, including the Great Depression, we have remained a financial and philanthropic pillar in our communities. In 2008, the financial crisis and onset of the Great Recession tested our resolve and core operating principles. When the federal government rolled out its taxpayer-funded Troubled Asset Relief Program (TARP) for financial institutions needing greater capital and liquidity, Mechanics Bank had the luxury of being one of the first banks in the country to say, “No, thank you.” Weathering the nation’s worst economic and financial crisis in more than half a century, the bank reached the $3-billion asset mark in 2011.

Strategic acquisitions have also contributed to our growth during the last decade. In 2016, we acquired California-based California Republic Bank (CRB), a commercial and private lending institution. The addition of CRB opened new markets in Southern California and helped the bank expand its presence in the southern part of the state. Two years later, we grew to $6 billion in assets with the acquisition of the historic 150-year old Scott Valley Bank in Northern California.

In September 2019, we acquired the retail, business banking, commercial real estate, mortgage and wealth management businesses of Rabobank, N.A., as well as its 100-branch office network. This strategic merger brought together two community-oriented, well-capitalized banks with common values and deep roots in California – and assets totaling more than $17 billion, and branches throughout the state.

In an historic transaction six years later, Mechanics Bank merged with HomeStreet Bank, creating a premier West Coast community bank with 166 branches in California, Washington, Oregon and Hawaii, and more than $22 billion in assets.

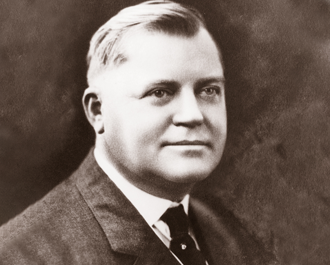

Throughout our growth and expansion, we have maintained our commitment to the values and the culture that have defined us over the past century. Working together with our clients and within our communities, we take pride in partnerships and relationships that support, sustain and encourage innovative stewardship and economic prosperity. And that’s why, following in the footsteps of the great E.M. Downer, we continue to work hard to earn your trust, serve all of your financial needs and support our local communities.