Please see the sections below or use the search feature to find answers to questions about Mechanics Bank Auto Finance and managing your auto loan.

For Consumers - Online Account Management & Login FAQs

You can access your account online through myaccount.mechanicsbank.com, via the Mechanics Bank Auto Finance mobile app, or by calling Mechanics Bank Auto Finance at 1.855.272.2886.

When calling Mechanics Bank Auto Finance (1.855.272.2886), you will need your 7-digit account number, or any phone number associated with your account AND and the last 4 digits of the Social Security number associated with the phone number.

You can register your account online at myaccount.mechanicsbank.com or via the Mechanics Bank Auto Finance mobile app. You will need your 7-digit account number, the last four (4) digits of the primary account holder's Social Security number, and the primary account holder's zip code.

If you are locked out of the website or mobile app:

- Website: myaccount.mechanicsbank.com

- Click on the “Forgot Username/Password?” Link.

- Enter your Username or Email and Account Number.

- A reset email will be sent to the primary email address associated with the online profile

- Please allow up to 5 minutes to receive the password reset email.

- If you have not received the password reset email, please check your spam or junk folder.

- Mobile App: Access the Mechanics Bank Auto Finance application

- Password Reset:

- Click on “Sign In”.

- Then Click on either “Forgot Password”.

- Enter your username, then click “Send Email”.

- A reset email will be sent to the primary email address associated with the online profile.

- Please allow up to 5 minutes to receive the password reset email.

- If you have not received the password reset email, please check your spam or junk folder.

- Forgot User Name:

- Click on “Sign In”.

- Then Click on either “Forgot Username”.

- Enter your email (associated with your online profile) and enter your 7-digit account number.

- Then click “Send Email”.

- A reset email will be sent to the primary email address associated with the online profile.

- Please allow up to 5 minutes to receive the password reset email.

- If you have not received the password reset email, please check your spam or junk folder.

- Password Reset:

If an email is not received please contact us at 1.855.272.2886

At this time, only the primary account holder can register an account online. To update contact information for the co-borrower, please call 1.855.272.2886.

For Consumers - Payment FAQs

- Auto Pay - Never forget to make your monthly payment again! Auto Pay automatically transfers funds from your checking or savings account each month to make your monthly payment. It’s fast and easy to enroll: Simply log onto your account at myaccount.mechanicsbank.com and navigate to the Payment Center tab to setup your recurring payment schedule.

- NOTE: If you setup Auto Pay on or after your due date, the payment will not be processed until the next payment. If you setup Auto Pay within 3 days of the due date, the recurring payment will be processed.

- The processing time may take up to 48 hours. Please ensure you have verified your bank information is correct for accuracy.

- Please call 1.855.272.2886 if you have any questions regarding your payment.

- Pay Online - If you are registered on myaccount.mechanicsbank.com or the Mechanics Bank Auto Finance Mobile App, you can setup automatic payments (Auto Pay).

- Pay Online - If you are registered on myaccount.mechanicsbank.com or the Mechanics Bank Auto Finance mobile app, you can make one-time payments or setup automatic payments.

- Pay by Mail - To make a payment by mail, please send a check or money order to: Mechanics Bank, PO BOX 25085, Santa Ana, CA 92799-5085 Please include your account number on the form of payment.

- Pay by Phone - By calling 1.855.272.2886, you can make a one-time payment by phone. A money transfer fee may be charged per transaction.

- Pay by Text - To make a payment by text, register your account online at: https://internet.speedpay.com/MechanicsBank/. A money transfer fee may be charged per transaction and the amount of the fee will be disclosed prior to making your transaction.

- Pay in Person - Payments are accepted at Mechanics Bank branches in California, however, we do not accept payments at our Mechanics Bank Auto Finance locations. When making a payment in a branch, please have your account number available. Find the nearest Mechanics Bank branch.

Please call 1.855.272.2886 if you have any questions regarding your payment.

- Western Union: Pay at any Western Union location using your account number, Code City and Code State when locating the nearest Western Union location. A money transfer fee may be charged per transaction and the amount of the fee will be disclosed prior to making your transaction.

- Code City: MBAUTOFINANCE

- Code State: CA

- MoneyGram: Pay at any MoneyGram location using your account number and Receive Code when locating the nearest MoneyGram location. A money transfer fee may be charged per transaction and the amount of the fee will be disclosed prior to making your transaction.

- Receive Code: 8288

- Please call us at 1.855.272.2886 to provide your transaction code for tracking once you have made your payment.

- Principal Only Payments - Principal only payments can be requested by mail, phone call, fax, email or in a Mechanics Bank Retail Branch.

Mail Principal Only payments to: Mechanics Bank Auto Finance, 2495 Village View Drive, Suite 190, Henderson, NV 89074.

Fax your request to: 714.242.2198

Email your request to: customerservice@mechanicsbank.com

-

Include your Mechanics Bank Account number when making a Principal only request.

- Include instructions on how to apply funds. Example: Total enclosed is $3,000. Please apply $2,500 to Principal and $500 to June installment.

-

When sending a fax or email, please indicate the date and amount of the payment you are requesting to be re-applied. Example: Payment made on May 15 for total amount of $3,000. Please apply $2,500 to Principal and $500 to June installment.

-

Note: Your account must be current to apply a Principal only payment.

-

Please call 1.855.272.2886 if you have any questions regarding your payment.

Not at this time. However, you may be able to setup an alert with your bank when a withdrawal is made. Please contact your financial institution to see if this service is available.

Auto Pay can be cancelled on our website or mobile app by navigating to the Payment Center, Recurring Payments section.

The cutoff time to post your payment same day is 7:00 PM PST Monday through Friday, and 4:00 PM PST Saturday and Sunday.

Yes, there is a maximum combined amount of $2,999.99, or two times your monthly regular payment, whichever is greater within a 30 day period.

Please Note: If multiple payments are made within 5 minutes of each other, the latest one will be deleted.

For additional payment options, please call us at 1.855.272.2886.

Once a one-time payment is submitted, it can not be cancelled. Please contact us at 1.855.272.2886 if you have questions regarding a payment.

To cancel an over-the-phone payment, please call us at 855.272.2886. Provide the date of current day or future payment to be cancelled.

Note: Debit card payments cannot be cancelled.

Online payment options may be restricted for various reasons, including but not limited to, your account status. If you are having trouble making a payment online, please call us at 1.855.272.2886, or refer to our payment options listed above.

Please try to avoid late payments. You may be charged a late fee if you haven't made your auto loan payment by 11:59 PM CT on the day your grace period ends. You can find your grace period info in your contract. When you make a late payment, you will also accrue more interest by putting more days between payments. By making on-time payments, you'll satisfy your loan balance and the interest due by the loan's maturity date. Please see the FAQs under Simple Interest for additional information.

For Consumers - Payoff FAQs

The Payoff Amount includes the full principal balance, accrued interest, and any applicable fees. It is the amount needed to payoff your account in full if the payment is received that day.

You can obtain a payoff quote by logging into your account on our website or mobile app, or by calling 1.855.272.2886.

Payoff should be made by check or certified funds (cashiers check or money order). Please send the check or money order payable to Mechanics Bank to the address below. Remember to fill in all sections and write the account number on the check or money order. Do not send cash or wire transfer. Please avoid placing restrictive comments on the front or back of the check, such as "payment in full" as this may result in a delay in processing the funds or in funds being returned to the remitter.

If paid by a Finance Company, Dealership or Insurance Company, please complete an authorization form. This form permits Mechanics Bank to release title to the remitter. If the account is paid-in-full by the customer, there is no need to complete the authorization form.

Payoffs can be mailed to:

Mechanics Bank

2495 Village View Drive, Suite 190

Henderson, NV 89074

Payoffs may also be made online or over the phone if they don't exceed the maximum allowable for these payment services.

If located in California, you can make your payoff at the nearest Mechanics Bank branch.

A payoff letter is not available on the website. If you require a letter, you may request it by calling us at 1.855.272.2886 or sending an email to customerservice@mechanicsbank.com with the following information:

- First and Last Name on the Account

- 11-digit account number located on your statement

- Note: You must use the email address associated with the account to send this request to ensure delivery of the payoff letter.

Your final payment will not be automatically withdrawn. You may make your final payment in the following ways:

- Online at myaccount.mechanicsbank.com with a one-time ACH

- By phone with Customer Service at 1.855.272.2886

- Bill Pay through your financial institution - you can set up a one-time payment through your bank using Bill Pay services

- Via Mail to 2495 Village View Dr., Suite 190, Henderson, NV 89074

- If located in California, the nearest Mechanics Bank branch

Yes, how you pay may affect lien or title release timing.

Ceritified Funds Payoff: If you pay by dealer or cashier's check, MoneyGram, Western Union, debit card, or cash at a Mechanics Bank branch, Mechanics Bank Auto Finance will begin the lien release process the next business day after receipt of the certified funds.

Non-Certified Funds Payoff: If you pay by personal or business check, Mechanics Bank mobile app, phone, or online, it may take up to five (5) business days after the receipt of the uncertified funds before Mechanics Bank begins the lien or title release process as we must allow time for the funds to clear.

A paid-in-full letter is not available on the website or app. Please wait 30 days from date of payoff posting to your loan before requesting a paid in full letter. Paid in full letters are mailed when the title is released and title release times vary by state. If after 30 days a letter has not been received, please contact us at 1.855.272.2886 or email your request to customerservice@mechanicsbank.com. Please include your first and last name, account number and a contact number with your request.

Mechanics Bank Auto Finance will release the title or its equivalent only after the loan is paid in full. To view your loan payoff balance, log in to your account at myaccount.mechanicsbank.com or Mechanics Bank mobile app. You can also obtain your payoff balance by calling 1.855.272.2886

For Consumers - Titles FAQs

Refer to your new state of residence for its registration requirements. If your new state requires the title in order to register your car, please contact Mechanics Bank Auto Finance at 1.855.272.2886.

Please Note: Mechanics Bank Auto Finance does not send title on past due accounts. The account must be current for a title to go out.

Refer to your state of residence for its registration requirements. If your state requires the title in order to change the name on the title, please contact Mechanics Bank Auto Finance at 1.855.272.2886.

Please Note: Mechanics Bank Auto Finance does not send title on past due accounts. The account must be current for a title to go out.

Our title release timelines vary by state and whether you have paid off with certified or uncertified funds. You may check the status of your title or lien release by accessing your auto loan account online or using our automated phone system.

We have outlined below what to expect in most cases based on where your vehicle is registered. If you have questions about your state's process, please contact the Department of Motor Vehicles or applicable state titling agency (DMV). All title release documentation will be sent to the authorized party.

For Consumers - Simple Interest FAQs

On a simple interest contract, finance charges are calculated based on the unpaid principal balance of the contract. As each payment is made, the payment amount is applied toward the finance charges that have accrued since the last payment was received. The remaining portion of the payment is applied in accordance with the terms of your contract.

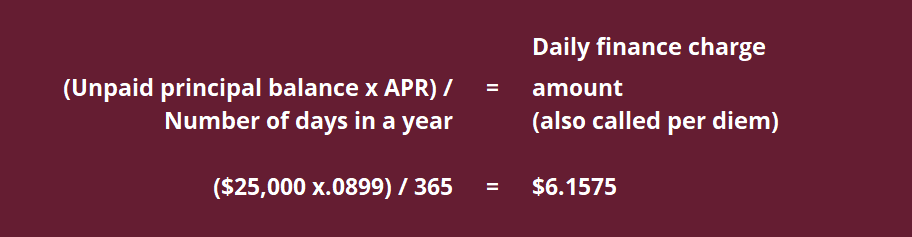

Finance charges accrue daily based on the unpaid principal balance. For example, if the unpaid principal balance on your account is $25,000, your Annual Percentage Rate (APR) is 8.99% and your normal monthly payment amount is $518.83, your daily finance charge amount is calculated as follows:

If we received your payment 28 days from the date we received your last payment, your finance charge for that period would be $172.41 ($6.1575 x 28). Finance charges are paid first and the remainder of the payment is applied in accordance with the terms of your contract. Your payment will be applied as follows:

Finance Charges $172.41

Principal $346.42

Total $518.83

For your next payment, the unpaid principal balance would be $24,653.58

($25,000.00 - $346.42). The daily finance charge amount is calculated as follows:

If we received your payment 31 days from the date we received your last payment, your finance charge for that period would be $188.24 ($6.0722 x 31). Your payment will be applied as follows:

Finance Charges $188.24

Principal $330.59

Total $518.83

The finance charges will vary based on the timing of your payments. The earlier you make your payments before the due date, the less finance charges you pay. The later you make your payments after they are due, the greater the finance charges. This illustrates the importance of making payments on time.

In the previous example, if we receive your payment 31 days from the date we received your last payment, your finance charges for that period would be $188.24 ($6.0722 x 31) and your payment would be applied as follows:

Finance charges $188.24

Principal $330.59

Total $518.83

However, if we receive and apply your payment 28 days from the last payment received, your finance charges for that period would be $170.02 ($6.0722 x 28) and your payment would be applied as follows:

Finance charges $170.02

Principal $348.81

Total $518.83

Similarly, if you send in additional funds to be applied towards your principal, you may reduce the finance charges you pay over the term of your contract, assuming you continue to make your normal monthly payment on or before the scheduled due date. It is important to remember that finance charges are calculated on your declining principal balance. Your daily finance charge declines as your principal balance declines.

Your last payment will probably be different from the amount disclosed in your contract. The amount of your final payment will depend on your payment history throughout the term of your contract. If you consistently pay early or make additional principal payments, your last payment should be lower. If you pay late, your last payment should be higher.

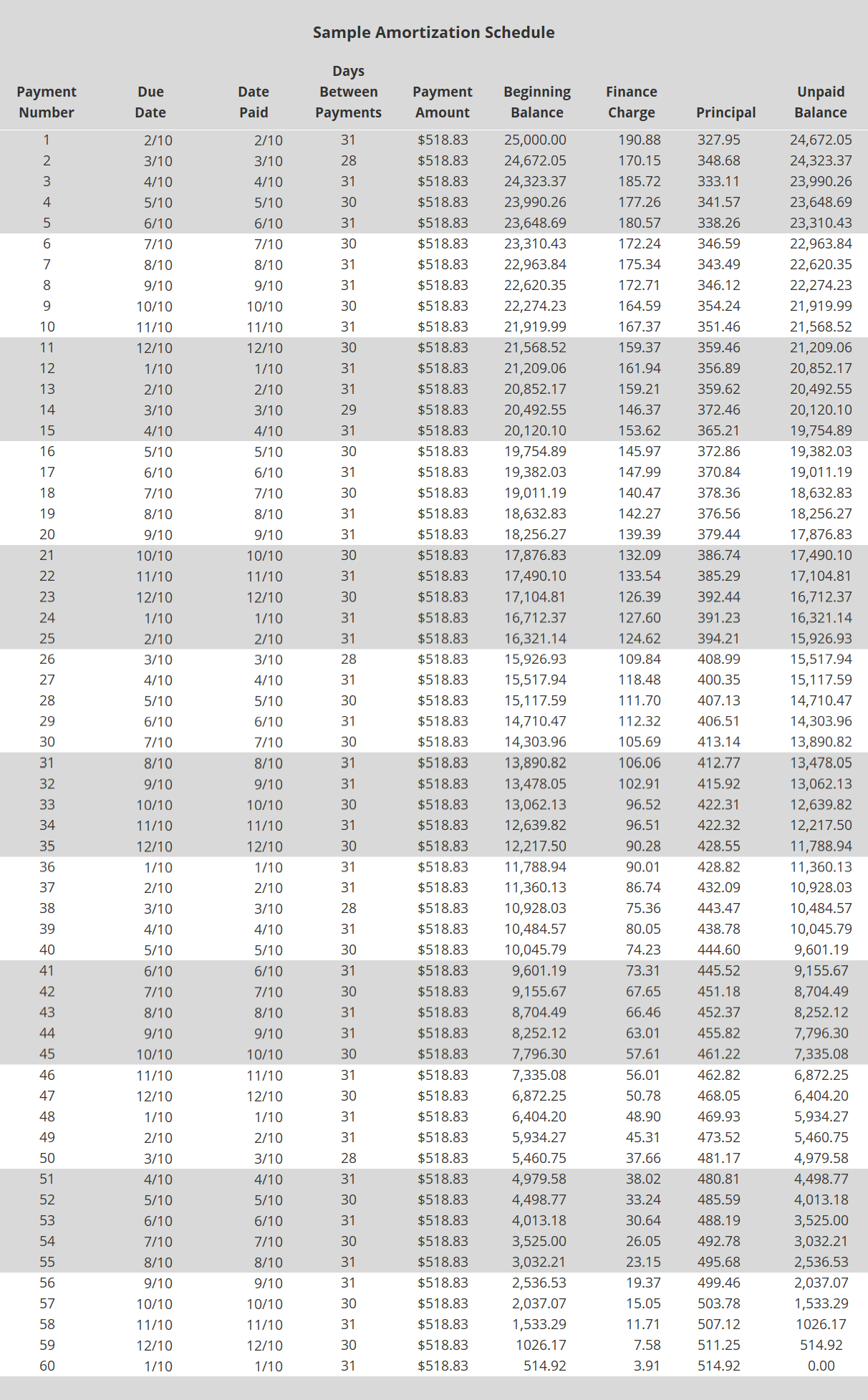

This schedule for a simple interest contract is provided for your reference. The principal and finance charge amounts are approximate. Any variance from the schedule will affect the amount of finance charges owed per payment and over the term of the contract.

Contract Start Date: 1/10

Beginning Principal Balance: $25,000.00

Term (months): 60

Annual Percentage Rate: 8.99%

Monthly Payment: $518.83

First Payment Due Date: 2/10

Scheduled Total of Payments: $31,129.80

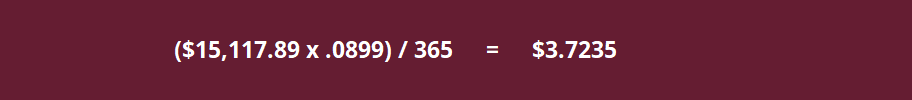

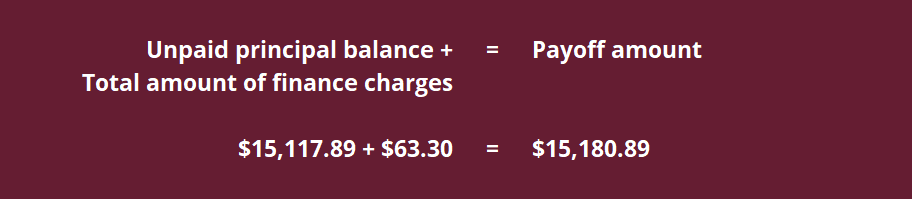

Assume you have made 27 payments and your unpaid principal balance is $15,117.89. Fourteen (14) days have elapsed since your last payment and the payoff is valid for 3 days. The daily finance charge amount would be calculated as follows:

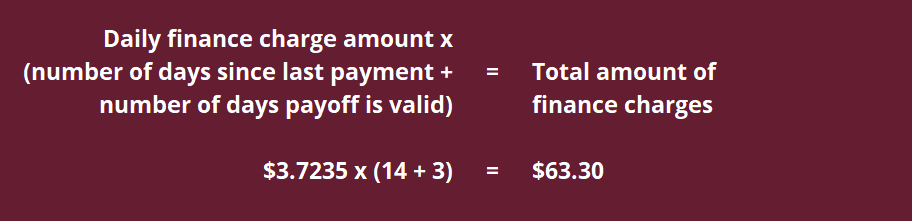

The total amount of finance charges included in the payoff would be:

The payoff would be calculated as follows:

Remember that this example is provided for your reference only. The principal and finance charge amounts are approximate with any variances affecting the early payoff amount.

For Consumers - Insurance FAQs

If a Total Loss has occurred, please have your insurance company call Mechanics Bank Auto Finance Customer Service at 1.855.272.2886 and provide us with complete insurance information. Then, we can begin working with your carrier to receive insurance proceeds. After your insurance pays the settlement, you will be responsible for any remaining balance. If you have GAP or other debt protection coverage, we encourage you to reach out to the provider as soon as possible to determine what documentation will be needed to process the claim.

You remain responsible for making monthly payments until the loan is paid in full and any missed or partial payments may be reported to the credit bureaus. If the insurance proceeds results in an overpayment, a refund will be sent after payoff. For questions on your account, please call Mechanics Bank Auto Finance Customer Service at 1.855.272.2886.

A paid in full letter is not available through our website or mobile apps. Paid in full letters are mailed when the title is released and title release times vary by state. If after 30 days a letter has not been received, please contact us at 1.855.272.2886 or email your request to customerservice@mechanicsbank.com. Please include your first and last name, account number and a contact number with your request.

Insurance companies can deduct for mileage, prior damage, tax added on contract (for some states), etc. Please contact your insurance company for breakdown statements.

Please refer to your GAP policy for specific information on coverage and how to file a claim. If you cannot locate the GAP policy you purchased from the dealer, please contact the dealer directly to obtain a copy.

You can mail the repair check along with photos of the repairs to the following address:

Mechanics Bank Auto Finance

P.O. Box 98541

Las Vegas, NV 89193

Please ensure you provide your account number on all documentation sent.

After receiving pictures of the repairs, Mechanics Bank Auto Finance will endorse the back of the check and send it back to you.

For Consumers - Aftermarket FAQs

Aftermarket products are optional products, services or insurance that may be purchased when you buy your vehicle. They may cover unforeseen vehicle repair needs or assist with loan payments.

Common examples include:

- Guaranteed Asset Protection (GAP)

- Service Contracts

- Anti-theft protection

- Maintenance packages

- Credit Life Insurance

- Credit Disability Insurance

Please refer to your contract or dealer for additional information on specific products.

Contact the dealership or the coverage provider; their contact information is listed on the aftermarket product contract.

Contact the coverage provider for information on how to file a claim or how to use the product; their contact information is listed on the aftermarket product contract. Your coverage provider will let you know if they will reimburse you for expenses or if they will pay the expenses at the time a covered service is performed. They will also explain other conditions, such as requiring that the maintenance be performed at the dealership where you purchased the vehicle.

The aftermarket product contract will state whether the product can be canceled. Generally speaking, product or services that have already been provided cannot be canceled. Contact the dealership or coverage provider if you have questions.

The aftermarket product contract may say whether you are entitled to a refund. If it does not, contact the dealership or your coverage provider for information regarding whether you are entitled to a refund and what amount, if any, is owed. The coverage provider's information is listed on the aftermarket product contract.

For Consumers - Credit Reporting FAQs

Credit reports are compiled and created by independent credit reporting agencies (CRAs) unaffiliated with Mechanics Bank Auto Finance, like Equifax, Experian, and TransUnion. The CRAs compile data related to your payment history and loan balances that are reported to them by independent creditors or data "furnishers" like lenders and auto finance companies. Credit reports contain a range of information - everything from personal details like names and Social Security numbers to specifics about auto loan payments and repossessions. It gives a view of your overall credit and debt history, like how often you make payments on time, how much credit you have, and how much credit you're using. Reviewing credit reports helps lenders decide if they will loan money to you and what interest rates and other terms they will offer.

Individual consumers may request a credit report directly from the CRAs by contacting them at:

- Experian - www.experian.com

- Equifax - www.equifax.com

- TransUnion - www.transunion.com

Credit reporting agencies (CRAs), like Equifax, Experian and TransUnion, prepare your credit report. a CRA receives credit information from "furnishers," like lenders and auto finance companies, that extend credit. Information provided by furnishers, including Mechanics Bank Auto Finance, must be accurate and complete. We furnish information on payment history, such as whether you made your payment on time or late. Like other creditors, on a monthly basis, Mechanics Bank Auto Finance provides CRAs with an automated report containing payment history data for its borrowers. If applicable, the Bank may also include an account's status, such as whether a vehicle was repossessed or an account was paid in full or settled in full for less than the full balance.

Credit reporting agencies (CRAs), like Equifax, Experian, and TransUnion, generally can report most negative information for seven (7) years. CRAs determine how long they will report information about a specific account (i.e., tradeline), as permitted by law. Account statuses in certain situations (e.g., bankruptcy) could remain on a credit report for up to 10 years.

Of important note, delinquent payment history is not deleted from your credit report once you become current, pay your balance in full, or settle an account for less than the full balance owed. In other words, your past negative payment history is not replaced by future positive payment history. This is one reason why it is very important to make each and every monthly payment on time.

On a monthly basis, Mechanics Bank Auto Finance notifies credit reporting agencies (CRAs), like Equifax, Experian, and TransUnion, that account 30 or more days past due are delinquent. CRAs typically display this late payment information on a credit report where it can remain for as long as seven (7) years. Note that neither you, nor credit repair companies acting on your behalf, have a right to remove accurate late payment information from a credit report.

The Fair Credit Reporting Act (FCRA) gives you the right to dispute information you believe to be incomplete or inaccurate and requires furnishers like Mechanics Bank Auto Finance to conduct reasonable investigations of disputes. If you believe that the late payment shown on your credit report is inaccurately reported, you can file a dispute with the credit reporting agencies (CRAs), like Equifax, Experian and TransUnion.

We will investigate your dispute using the information provided, and respond within 30 days. If any changes are deemed necessary, note that the CRAs will typically update your credit report(s) within 1-2 billing cycles after the investigation is complete.

Filing a Dispute with the CRAs:

- Equifax: 866.349.5191

- Experian: 888.397.3742

- TransUnion: 800.916.8800

If you are a victim of identity theft, you can file a report with the Federal Trade Commission (FTC) and with the police. If you notify Mechanics Bank Auto Finance of your identity theft claim, please provide supporting documentation, such as an FTC or police report and proof of your identity. The Bank may request that you provide additional supporting documentation beyond these items to assist the investigation. Once the Bank has completed our investigation, you will be notified in writing of the findings and any actions taken.

For Consumers - Statement Documents FAQs

To enroll in eStatements, simply log into your account at myaccount.mechanicsbank.com or Mechanics Bank Auto Finance mobile app and navigate to the My Info tab to update your preference for eStatements.

At this time, enrollment for eStatements is only available by registering your accounts at myaccount.mechanicsbank.com or the Mechanics Bank Auto Finance mobile app.

Using your electronic statement for mailing in your payments may cause a delay in processing. For other payment options, please see the additional payment options listed here or call us at 1.855.272.2886 or email your request to customerservice@mechanicsbank.com indicating your Name and Account Number.

For Consumers - Financial Difficulties & Hardship FAQs

Extensions may be granted if certain account criteria are met. To request an extension, please call us at 1.855.272.2886 to see if you qualify.

A Due Date may be granted once over the life of a loan.

To inquire about a due date change, please call us at 1.855.272.2886 or email customerservice@mechanicsbank.com. Please include your Name and Account Number along with the day of the month you are requesting your due date.

Please Note: Your due date can only be changed between the dates of the 2nd through the 17th of the month.

Changing your due date will likely result in additional interest accruing. This may also result in your loan having an outstanding balance at maturity. Please refer to the Simple Interest section of the FAQs for more information.