What is Standard FDIC Insurance?

Standard FDIC insurance coverage is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC provides separate coverage for deposits held in different account ownership categories. If you’re strategic with these account ownership categories you can expand and maximize your FDIC coverage without requiring multiple banks.

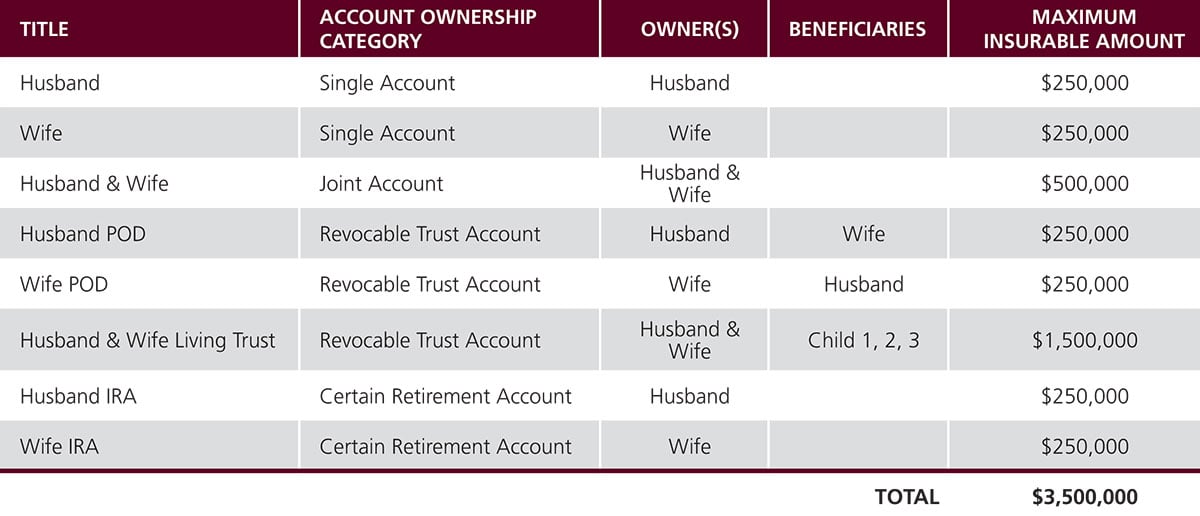

Examples – Family of Five1

This chart illustrates how a husband and wife with three children could qualify for up to $3,500,000 in FDIC coverage at one insured bank.

This example assumes that the funds are held in qualified deposit products at an insured bank and these are the only accounts that the family has at the bank.